In 2026, women’s CS2 is entering not a “new era,” but an infrastructure vacuum. As of the end of 2025, ESL FACEIT Group officially announced the suspension of ESL Impact after Season 8, explicitly stating the reason: the current economic model “is not sustainable” despite significant investments (pro.eslgaming.com). This is an important starting point to fix in place: women’s CS2 did not “fail” as a game or a scene — the product that was supposed to convert interest and talent into a reproducible economy failed.

Below is a detailed picture of what exactly was built, what failed to add up in the numbers, why organizations leave even when there is a fan base, and what a viable “Impact-after-Impact” business model could look like (without banalities like “we just need more support”).

From 2022 through the end of 2025, ESL Impact was effectively the only global, regular product for women’s Counter-Strike; Liquipedia records the series’ total prize pool at approximately $1.2 million over its entire cycle (Liquipedia).

At the same time, in 2025 ESL attempted not merely to “increase prize money,” but to repackage incentives for clubs:

In other words, ESL had already diagnosed the core problem: prize money for players does not equal profitability for clubs. It tried to give organizations a second monetization path — through content and a separate share of rewards.

On paper, this looks solid. In practice, the system failed to generate stable “revenue from the audience” and remained dependent on budget injections from the organizer.

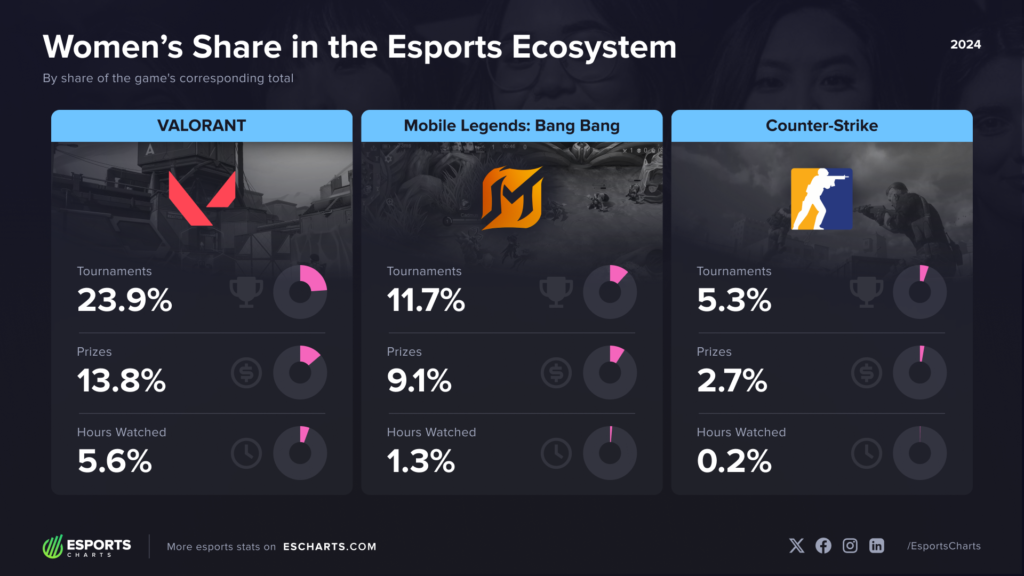

According to Esports Charts estimates, women’s tournaments account for about 5% of the Counter-Strike ecosystem, while women’s competitions represent roughly 2.7% of the discipline’s total prize pool (escharts.com)

This is not a moral argument — it is a structural one: when the share of events and prize money is this small, the scene cannot be self-sustaining through competitive dynamics alone.

ESL Impact provides a very illustrative dynamic:

This is the key point: demand exists, but it is nonlinear and dependent on specific narratives, “locomotive” teams, and co-streaming. Esports Charts explicitly highlights the role of community casters (for example, Gaules) as a factor capable of “switching” an event into a different tier of visibility (escharts.com).

The contrast in scale also matters: major CS events collect tens of millions of Hours Watched (for example, Esports Insider describes the 2025 Austin Major as record-breaking in Hours Watched). Against this backdrop, the women’s scene cannot “win” in absolute numbers — it must win as a niche product with a predictable economy. (Esports Insider)

The best example is NAVI. The organization officially shut down NAVI Javelins, explaining that the business model of the women’s segment was “unsustainable” and did not allow for long-term planning (navi.gg)

This is not an isolated case: ESL directly cited economic unsustainability as the reason for suspending Impact. (pro.eslgaming.com)

To avoid slipping into “obvious statements,” here are three concrete economic gaps that systematically hit women’s CS2:

Prize money is variable and competitive, while club costs are recurring (salaries, bootcamps, management, psychologist/analyst, travel/visas, equipment). ESL added club shares and content incentives in 2025 precisely because the baseline approach was not working (HLTV.org).

But even with a club share, organizations do not receive “market-generated revenue” — they receive a subsidy from the organizer, which can be discontinued (as it was).

In men’s/mixed CS, sponsorship inventory is monetized thanks to scale and the stability of the top-tier calendar. In women’s CS2, viewership can spike to 100K peak viewers (Season 7) and then drop to 6K (Season 8) (escharts.com).

For a brand, these are different products: one is “visible,” the other is “reference-level.” A club cannot plan expenses around a “reference-level product.”

This is less obvious, but it directly erodes quality. When the number of truly competitive teams is small, it leads to:

The result: transitions into the “main” scene are rare, and without them there are no “success stories,” which are the most effective way to sell the product.

HLTV explicitly describes an “uncertain future” while listing parallel islands of activity that could potentially become a “modular replacement” for Impact: JB Pro League with a women-only tournament ($25K), Female Pro League with a LAN final in Kazakhstan, and ELITE FE (supported by Vitality and Skin.Club) (HLTV.org).

This is important: 2026 does not mean “the end.” It means fragmentation into several independent circuits, where:

In short: women’s CS2 has almost no problem with “mission.” The problem lies in the product and monetization. Therefore, the model must rest on three pillars — competition, content, and fan monetization — and unite them into a single P&L.

The most stable revenue stream in esports is not sponsorship — it is direct fan payments for digital assets or privileges. In CS, this historically works through the cosmetics ecosystem, but the women’s scene has no “built-in” tool from Valve. Therefore, a realistic option for 2026 is:

The key point: clubs receive revenue that grows with the fan base, not only “win the tournament — earn money.”

ESL has already shown that a LAN final works as an “anchor” (HLTV.org).

For 2026, a more viable structure is:

In 2025, ESL introduced short-form and long-form incentives (pro.eslgaming.com).

The problem with such programs is often that clubs optimize for “content output,” not distribution. Therefore, the KPI must be combined:

In 2026, the women’s scene does not win when it “catches up” to Tier-1 CS. It wins when it delivers a regular competitive and content product, while the best players get a real pathway:

This creates growth stories — the factor that most strongly converts audiences into paying fans in women’s CS2.

The facts of 2025 show everything at once:

Therefore, the 2026 question is not “whether women’s CS2 is needed,” but which product will make it self-sustaining: one with direct fan monetization, controlled costs, and a mechanism that pays clubs for audience scaling — not only for their position in the standings.

Article by Dmytro “Bamb1ni” Kuzmenko

Telegram channel: Big Bro Bamb1ni

Instagram: Bamb1ni