If in 2020–2022 women’s esports in shooters often looked like a collection of fragmented “showcase” tournaments, by 2026 Valorant has become, without exaggeration, the most formalized and best-designed ecosystem for women and other gender-marginalized players. Its core is VCT Game Changers (GC): a globally aligned framework with seasonal regional leagues, a unified qualification logic through Circuit Points, a centralized international final, and—crucially—a media product that “knows how to sell itself” to audiences through engagement tools such as Pick’Ems, drops, and co-streaming. (valorantesports.com)

The paradox of 2026, however, is that the strongest system on the market has simultaneously exposed its most painful pressure points: volatile viewership, fragile team economics, and the “glass ceiling” between GC and the main VCT. It is precisely along these three lines—media/money/upward mobility—that it is being decided today whether women’s Valorant will become a “permanent industry” or remain a “well-packaged exception.”

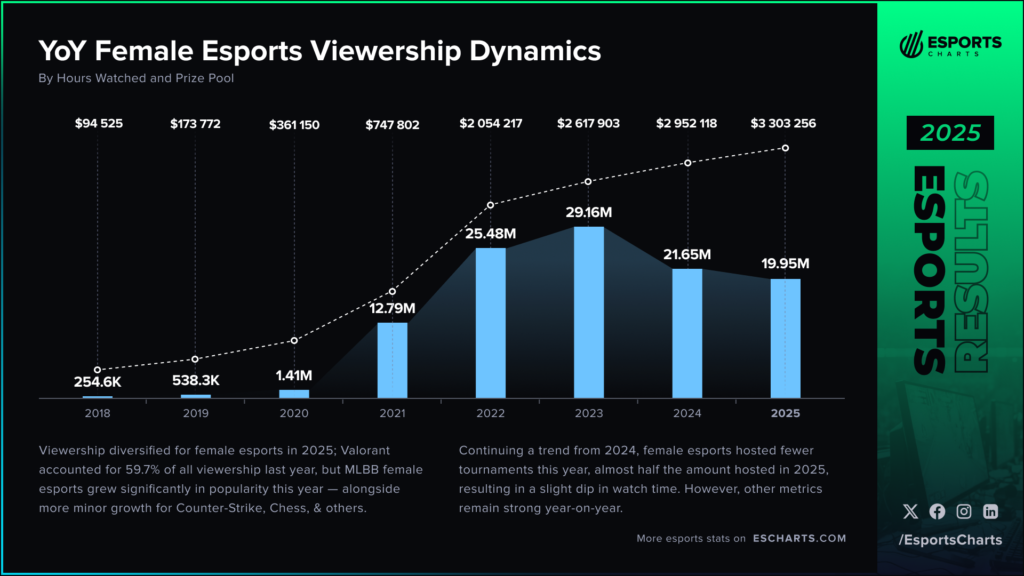

At the start of 2026, two trends are visible in women’s tournaments: a decline in total watch time and a sharp reduction in the number of events, combined with broader geographic reach and more distributed viewership (less concentration in one or two “super-events”).

The Esports Charts report on women’s esports in 2025 notes a ~7.9% year-over-year drop in watch time and a 52% decrease in tournaments, alongside a shift toward greater diversity of disciplines and events. (Esports Charts)

For Valorant, this is a crucial backdrop: GC becomes the industry’s “reference point” and a “demand channel” for sponsors. Brands are more willing to invest where rights are unified, schedules are predictable, products are clearly defined, and broadcast quality is controlled.

The Game Changers Championship 2025 illustrates how Riot builds the ecosystem as a funnel: many entry points → a standardized season → a global final.

A notable structural decision in 2025 reflects the “geopolitics of power” in women’s Valorant:

In 2026, Riot continues moving toward longer, more league-oriented formats, especially in NA. The Verizon VALORANT Game Changers NA 2026 page outlines the operating model:

The calendar is detailed down to qualifier dates and Swiss rounds (February–September 2026), alongside a lower-tier Raidiant Academy functioning as a semi-incubator for new rosters. (valorantesports.com)

This matters: in 2026, GC is no longer a once-a-year celebration but a continuous production line.

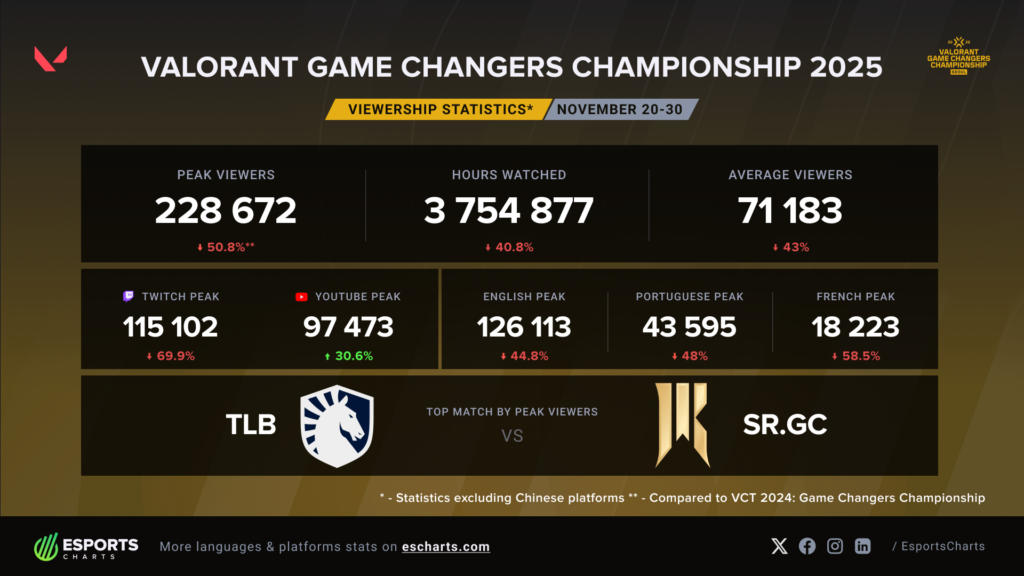

From a viewership perspective, Game Changers experienced a major turning point.

This was not simply “audience fatigue.” Two key details affect 2026 strategy:

This raises the issue of “media value” as a sponsor currency. The Esports Charts tournament page lists GCC 2025 Media Value at approximately $1,765,847 and names partners such as Red Bull, Secretlab, HyperX, Verizon, Mastercard, and Crunchyroll. (valorantesports.com)

Other reviews cite around $1.88M, likely due to methodological differences. The key takeaway: GC is now treated as monetizable inventory, but valuation still fluctuates. (valorantesports.com)

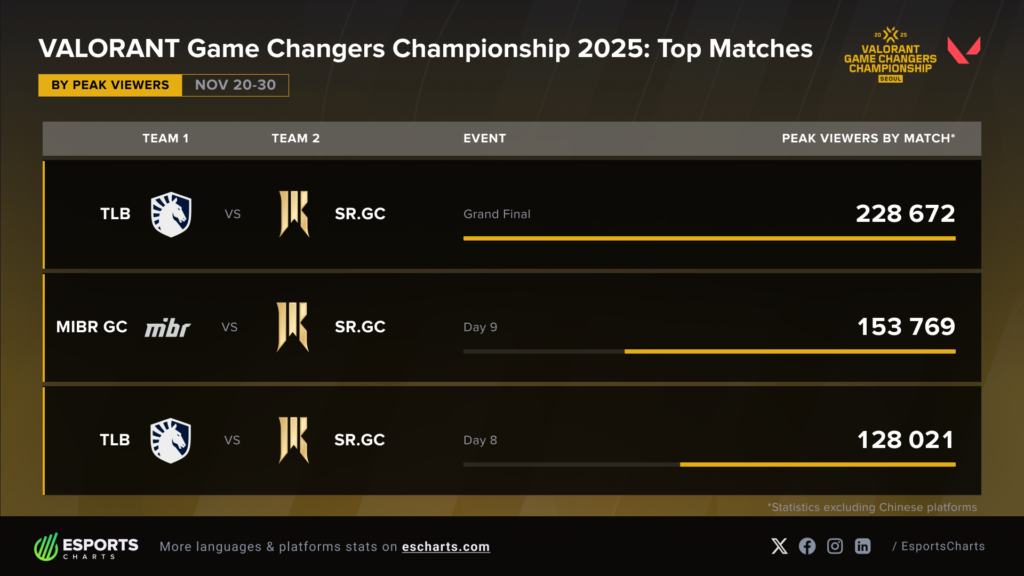

Despite declining metrics, 2025 delivered a strong competitive signal: Team Liquid Brazil won the championship, and matches against Brazilian teams became the core “most popular scenario” for audiences. (Esports Charts)

Riot’s 2025 season wrap-up notes that Brazil reached the GCC final for the third consecutive year and that GCC 2025 in Seoul had around 400 on-site fans. (Esports Charts)є

This matters for 2026 projections: women’s Valorant is no longer inherently NA/EMEA-centric. Power is mobile, and Riot institutionalizes this through Americas LCQ, four slots, and LAN events in São Paulo. (valorantesports.com)

Riot emphasizes that the goal is mixed competition without segregation, with GC as an entry and inspiration tool. (valorantesports.com)

In practice, however, top rosters compete in a predictable environment, sometimes adapting more slowly to Tier-2/Tier-1 than mixed-league teams.

A symbolic case is flor/florescent’s transition to International Leagues and GC teams’ participation in Challengers promotion events. (valorantesports.com)

Yet this also exposed the “cost of integration”: waves of toxicity and transphobia highlighted that moving beyond GC entails reputational and psychological risks. (Le Monde.fr)

Even with seven-figure media value and top sponsors, most teams cannot survive on prize money and partnerships alone.

In NA 2026, Riot improves conditions: longer seasons, Raidiant Academy, $150K prize pool, and Circuit Points as access currency. (valorantesports.com)

But across women’s esports in 2025, fewer events meant fewer monetization opportunities for smaller rosters. (Esports Charts)

Excessive broadcasting channels in 2025 reduced peak moments. (Esports Charts)

In 2026, GC must manage scarcity: deciding where to create unified attention windows and where decentralization via co-streaming is beneficial.

Riot already references GC participation in promotion events. (valorantesports.com) Next step: institutionalized transitional events, such as a seasonal “GC x Challengers Week” with incentives (points, seeds, invites, media packages).

Riot’s VCT 2025 wrap-up shows successful engagement monetization (e.g., 2M Pick’Em users for Champions 2025). (Esports Charts)

For GC, this implies shared revenue mechanisms: digital goods, cosmetics, event passes, or a transparent “GC development fund.”

In VCT 2025, Riot demonstrates its ability to monetize the ecosystem through engagement tools (Pick’Em in the client, mass activities) — for example, the seasonal wrap-up mentions 2 million Pick’Em users for Champions 2025 (as an indicator of the scale of this mechanic). (Esports Charts)

For GC, the logic is as follows: if GC is a brand asset and a talent pipeline, then it needs shared revenue mechanisms, not just prize pools. The simplest direction is expanding digital goods/cosmetics/event passes with a revenue share for the GC ecosystem (not necessarily partner teams, but at least a “GC development fund” with transparent distribution).

It is necessary to consciously plan where decentralization is useful (qualifiers, Swiss stage, academy) and where it kills the event (grand finals/decisive matches). Data from 2025 directly suggests that diluted attention became a factor in the decline. (Esports Charts)

The case of toxicity surrounding transitions to mixed leagues shows that safety and moderation are no longer just “ethics,” but an operational risk that affects organizations’ willingness to invest in players. (Le Monde.fr) In 2026, GC (and clubs) should treat this as a standard business function: public communication protocols, legal support in cases of harassment.

In 2026, women’s Valorant represents the strongest example of how an inclusive idea can be transformed into a system with calendars, rules, operators, metrics, and engagement tools.

At the same time, 2025 demonstrated that even the best-designed system is vulnerable to sharp viewership declines. True maturity begins when GC ceases to be a “parallel scene” and becomes a full-fledged preparation pathway to mixed Tier-2 and Tier-1 competition, with sustainable economics and effective risk management.

Article by Dmytro “Bamb1ni” Kuzmenko

Telegram channel: Big Bro Bamb1ni

Instagram: Bamb1ni